It was just three years in the making

Quick look

Here’s the quick summary for those of you who don’t have time to read the next 3,000 words.

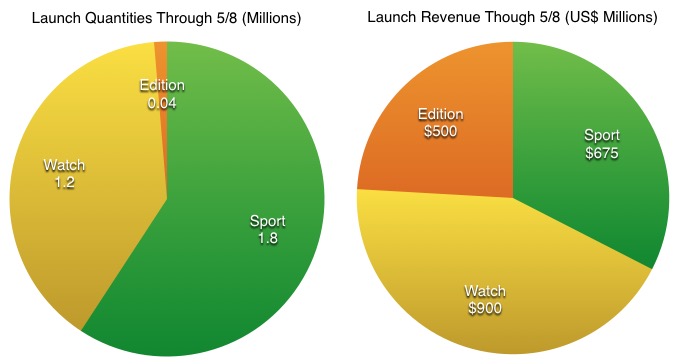

The Apple Watch went on sale for pre-orders on April 10, 2015, and the Apple Store tells us that delivery dates for all orders now stretch into summer and beyond. We know that the initial production run of Apple Watch has sold out; what we don’t know is how many Apple Watches that represents. I’ve built a simple model that predicts that the initial run of watches was more than 3 million units and will yield Apple Watch revenues of over $2 billion for the first two weeks of sales. While this figure is smaller than first weekend sales of iPhone 6 and 6 Plus, it dwarfs all other smartwatch sales to date and represents a milestone in wearable sales. The model suggests that while Sport Watch will lead sales in volume, selling 1.8 million units through May 8, Apple Watch will actually lead in revenue during that period, garnering about $900 million versus Sport’s $675 million. I also believe that Apple’s decision to introduce the Edition will be validated by $500 million in sales on only 40,000 units.

While I believe that these figures will be considerably below the number of pre-orders for Apple Watch, I believe Apple did this for an important reason. Apple is offering 38 different models of Apple Watch and it has no order history to go on. Instead of guessing at the right mix of models to manufacture, I believe that while Apple has manufactured a large number of Apple Watch electronics modules, it will perform the final assembly of actual products—the unique combinations of module, case, and band—to order. This approach will allow it to keep inventory costs low and satisfy as many consumers as possible.

The origins of this model

Now the long version.

In truth, projections like this are really just educated guesses, and mine is no exception. My work nowadays focuses on analyzing big data, though, and some of the techniques we use in that discipline are useful in making such educated guesses.

While I’ve been an industry analyst for nearly 20 years and have had Apple as a client, I have no inside or proprietary information on which to base this model. I have studied Apple’s strategy since the 1990s and have built predictive models about its business during that time using public information (see the section at the end of this posting for my bio and examples). However, I have no insight from Apple itself or from insiders at the firm.

In my experience, Apple runs its business along a few core principles that anyone can observe. Examples include straightforward values such as:

- Build only the best products.

- Care about every detail.

- Deliver great experiences for the customer, even if it costs more.

- Keep the development process secret.

- Every product should make money.

However, those principles drive Apple to use strategies which are at odds with others in the technology industry. Further, Apple’s secrecy around its development process make it very difficult for analysts to predict what the company will do. However, this secrecy does have an advantage for people like me: because I have access to the same public information as the institutional and industry analysts, my model can be as accurate or better than theirs. I also believe that by being transparent in how I come to my figures, I can improve the quality of conversation about Apple and its products beyond “link-bait” articles.

A thought experiment

Before I describe the model, I’d like you, the reader, to do a quick thought experiment.

Imagine that someone came to you and asked you to deliver a million Origami (that’s the art of Japanese paper folding) lobsters within the next month. Here’s a link to what one looks like courtesy of Jason Ku via MIT. How would you go about delivering on this order?

The task is clearly possible, but you face two problems: You can’t do it all yourself, and it’s a complex process.

The most straight-forward approach would be to hire about 10,000 of your closest friends to help you. Get some paper to each one of them and have each of them fold 100 lobsters. You gather up the results and you’re done.

There are a few problems with this approach. I don’t know how to fold an Origami lobster, I certainly don’t have 10,000 friends, and I don’t have a million pieces of paper (more like a million and several thousand; I don’t think they will all come out perfectly the first time). Even gathering up the million lobsters at the end is going to be a huge task.

All that said, this still is an achievable task given time and money. You could hire someone to document how to fold Origami lobsters. You could hire 10,000 people to do the folding. You could rent a big building where the people could do the work. You could buy the paper. You could hire people to gather up all the resulting lobsters.

Now let’s make this a little more realistic. As it turns out, we really want a million lobsters of two different sizes. Further, ordinary paper tears too easily and is the wrong color for Origami lobsters, so we’ve decided to make our own paper; that will require its own process. We also need to be able to deliver some of the lobsters with glitter and others with hand-painted decorations; we’ll need to plan to supply and apply those materials too. Oh, and we want to make a few thousand out of two colors of pure gold leaf instead of paper. You’ll have to manufacture the paper for that too.

What’s your plan look like now?

There’s no rush; you can deliver your million lobsters any time during the month, provided that you don’t mind people complaining that you are way too slow at getting this done. Oh, and you’ll be criticized in the international press for every failure to produce perfect lobsters.

And now, imagine this same plan, except with this twist: no one has successfully folded this particular type of Origami lobster before, so you really don’t know how it’s all going to turn out. And your reward if you are successful will not be praise, but demands that you build even more next month.

Congratulations. You’ve just imagined the scenario that Apple executives had to create for the launch of Apple Watch, except that Apple products are orders of magnitude more complex than paper lobsters. Also billions of dollars of revenue hang on you getting this process right the first time; if you don’t, your company and possibly the entire category of smartwatches will be deemed a failure. No pressure at all, really.

Assumption: Apple’s Watch strategy is about managing business risks

This thought experiment is my attempt to help people understand the challenge Apple faces in manufacturing and launching the Apple Watch at the scale Apple works at. Few people appreciate how complex Apple’s supply chain is for new products, especially when consumers worldwide demand these products for immediate delivery. Despite the fact that most Apple product launches make the process look easy, those launches pose multiple challenges that few other companies face including:

- Myriad parts and processes. Each Apple Watch consists of hundreds of parts. Many of these parts such as the cases are unique to Apple Watches, are manufactured on their own production lines and have their own build timelines. Having a variety of parts and processes makes the supply chain logistics more complex and prone to stock-outs.

- Multi-million unit volumes. Few electronic device manufacturers manufacture devices in the millions, and those that do typically spread out production over many months. Apple’s product launches create demands for millions of devices in just a few days to avoid disappointing buyers. Manufacturing on this scale is rare and this short time-frame is likely unique to Apple.

- Launches in several countries. Apple Watch will begin deliveries in Australia, Canada, China, France, Germany, Hong Kong, Japan, the UK and the US on April 24. This means Apple must manage its model production and output to meet the demands of 9 different consumer profiles, not just one.

- High margin demands. Apple requires that all of its product make money and not degrade its nearly 40 percent average gross margins. This means that even while launching a complex device using unique processes at multi-million unit volumes in 9 geographies, Apple intends to do so in a highly profitable manner.

I assume that Apple plans to keep these risks to a minimum by eliminating as many unknowns in the manufacturing and production process as possible. Specifically I believe that Apple’s strategy is to:

- Optimize Watch manufacturing around two core modules. Despite offering 38 different models of Apple Watch, Apple only really needs to make two sizes of the electronics module: 38mm and 42mm. Because these parts are used in all the models of Apple Watches made, Apple can make millions of both of these sizes knowing they’ll be used no matter which products consumers order.

- Customize Watch products at the last opportunity. Building huge inventories of all the models of watches and waiting for consumers to order them risks warehousing large quantities of unsold merchandise. That wastes capital. Instead, I believe Apple will build a smaller number of watches of each type for store and demo use and then do build-to-order final assembly of the actual cases and bands ordered.

- Use automated and well-understood production plans. Apple has a great deal of experience with high-volume new product manufacturing and launches. This includes the iPhone 6 and 6 Plus launch in the fall of 2014 where the company sold and delivered more than 10 million units in the first weekend. I believe that Apple will use largely the same production lines and processes for the Apple Watch to avoid having to build these high-volume, high quality processes from scratch.

- Build margin value through design. While Apple uses premium materials for the Apple Watch, I believe that the costs of those materials are small compared with the price of even the least expensive Apple Sport Watch. By designing cases and bands that command prices aligned with jewelry instead of electronics, Apple has positioned its smartwatch products to earn exceptionally high margins compared to its smartphone and computer lines of business.

With these assumptions in hand, we can begin to estimate what initial launch shipments will look like.

The data: scarce and governed by new rules

The launch of Apple Watch differs from prior launches of iPhones and iPads. Previously, the period between when consumers were allowed to pre-order products and when they would be shipped to them was only one week. With Apple Watch, Apple has left two weeks between the first date of preordering, April 10 and when orders will start shipping, April 24. Further, Apple has not guaranteed deliveries of any products on the first day of availability, April 24. Instead, it has provided all early buyers to expect delivery between April 24 and May 8. I believe this difference is important because it allows Apple to do something it hasn’t done before: Apple can use data from the early sample of pre-orders to guide final assembly and manufacturing of the bulk of products to be shipped.

While data about the pre-orders is scarce, some have gathered slivers of information which may or may not be helpful:

- Slice Intelligence estimates that US Apple Watch preorders were 957,000 in the first 24 hours. Based on a sample of its online shoppers—not necessarily a representative sample—each order was for an average of 1.3 watches, resulting in an estimate of 1.2 million sold during that period. Slice saw orders for Apple Watch Sport comprising 62 percent of sales, while Apple Watches comprised the other 38 percent. Apple Edition watches weren’t mentioned in the report.

- Quanta production estimates are between 1 and 2 million per month. An unknown source estimated that Quanta will have 3 to 5 million units available to ship on launch and will produce a total of 24 million watches in 2015. While we don’t know the source or accuracy of this data, it sounds reasonable compared to production numbers for other products such as iPhone. Given that production of Apple Watches started in January and is likely back-loaded in the year, that gives us a production rate of between 1 and 2 million units per month.

Given that the Slice data only represents one out of the 9 countries in which Apple Watches are sold and that we will have two weeks of store views and pre-orders in place before the first Apple Watches are shipped, I believe that demand will vastly outstrip Watch production through June 2015 and possibly beyond. It would also not surprise me to see China pre-orders exceed those of the US, which means that Apple may have 10 million or more pre-orders on its books by April 24. Therefore, my model assumes that production rates will be the limit of pre-order shipments through June.

Figure 1: Sport WaTCH Will Have The greatest Volume, But Apple Watch Will Drive The Most Revenue.

My model: Sport leads in volume, Watch leads in revenue

With all this data in place, my estimate of Apple Watch shipments for the period between April 24 and May 8 is as follows (see Figure 1):

- Apple will ship roughly 3.1 million Apple Watches in total. Assuming Quanta started watch production in January and has been producing somewhere around a million watches a month since that point, this figure feels within reason. It is far below the quantities of iPhone 6s Apple shipped its first weekend of availability, but I believe that Apple would rather have demand outstrip supply than the other way around. Building an inventory of 3 million watches up through the end March only carries about $2.5 billion in inventory risk, and those units are all but certain to be sold.

- Initial Watch shipments will consist of 1.8 million Sports, 1.3 million Watches, and 40,000 Editions. Both a survey on the site iMore.com and Slice have suggested a 60/40 split between the aluminum Sport and the stainless steel Watch. I also believe that Apple has manufactured about 5,000 each of the 8 different models of Apple Watch Editions to satisfy initial demand for that high end product, particularly in China.

- Initial sales revenue of more than $2 billion. If we apply these volumes to average selling prices of $375, $760, and $12,500 for the Sport, Watch, and Edition models, we see initial sales of the Apple Watch product line totaling $2.075 billion. While the Sport model ends up being the highest volume model, the highest revenue comes from the $900 million spent on stainless Apple Watches. Further, while Edition watch sales seem tiny, they represent a half billion dollar business in the initial shipment window, nicely validating Apple’s decision to explore the luxury smartwatch market.

Despite this very specific 3.1 million unit estimate, I place a great deal of uncertainty in that figure, just as you probably felt uncertain about your ability to produce a million Origami lobsters in the thought experiment earlier. All it would take is one manufacturing mistake in the Watch module process or a shortage of the fluoroelastomer used to make the Watch Sport bands, and production rates could be much lower. My 3.1 million figure simply represents a reasonable manufacturing plan that matches Apple’s track record in satisfying as many consumers as possible with their latest greatest product while keeping business risks to a minimu.

What about margins on these products? I think I’ll save that analysis for another posting, but my belief is that the Apple Watch product line will become Apple’s most profitable product line ever, with gross margins exceeding 60 percent. Why? Because the core electronics modules in the expensive models are the same ones used in the Sport models, and they just don’t cost that much. And while adding Gold cases and designer bands add cost to the bill of materials, the costs are small compared to the price premiums paid for these products. Unlike in the consumer electronics business, I see no pressure for prices to fall and if anything manufacturing costs will, resulting in a very profitable business.

What’s next: more of the same with adjustments

I believe that the 3 million Watches already in flight to consumers are simply Apple’s seeding of the market prior to adjusting the final assembly mix to the actual order flow. I also believe that Apple and Quanta have probably gained enough experience at this point to begin ramping up production to more than 2 million units a month during May and June, resulting in another 4 million or so units to be shipped prior to the end of the second calendar quarter. I don’t believe that this increased production will satisfy demand however, and I expect Apple Watches to be on back order through much of the summer.

For anyone waiting for a sleeker more refined Apple Watch 2.0, I believe you will have a long wait. Given the challenges in ramping up the production lines for these Watches, I expect that Apple Watch 2.0 will simply be a software update to the existing core electronics with additional bands and possibly another case color. Apple has plenty of room to refine its Watches for at least a year without changing the hardware one bit, and such an approach would amortize its production investments. Further, keeping the platform constant over one to two years ensures that developers have a consistent platform to create software for. To my mind, new Apple Watch 2.0 form factors are likely to wait until 2017, and it’s possible they could take longer than that.

If you insist on waiting for Apple Watch 2.0, though, you might try folding some Origami lobsters while you wait. They aren’t easy.

My credentials

My bio can be found on the main page of carlhowe.com. While I have analyzed Apple as part of my day-to-day work for nearly 20 years, I now spend my time consulting on big data for Think Big Analytics. This blog post is a labor of curiosity and should not be considered the opinions of my employers.

Readers may reasonably ask why anyone should believe my model over the myriad other forecasts that financial and industry analysts are promoting. After all, estimates of 2015 sales for Apple Watch range from 8 million to 60 million units. Sales of 3 million units on opening weeks would certainly run counter to the overall meme of “you’ll want one but you don’t need one.”

The truth is that none of us know how a brand new product category will sell with consumers. However, in my many years as an analyst and data scientist, I’ve successfully modeled how new Apple products sell many times. Here are a few of my predictions that were written up in the press; you can judge for yourself how accurate they were. Alternatively, you can always Google “Carl Howe predicts” and decide for yourself.

- 2008: Activation problems don’t stop iPhone from being largest CE launch in history

- 2010: iPad: $1 Billion Later, What Do You Think of It Now?

- 2011: WHOA! Apple Could Sell 4 Million Phones This Weekend

- 2012: Apple’s Latest IPhone Set to Become Best-Selling Gadget

- 2013: Android’s Leaky Bucket: Loyalty Gives Apple the Edge Over Time

Even before preorders Apple will have had some indication of the demand mix since the Apple Store app promoted the ability to “favourite” models near the top of the watch page.

I think Apple is best placed to understand the expected mix; they learned quickly that the majority of iPad customers wanted the 16GB, Wi-Fi version. However, in order to maintain profitability, Apple restricted supply of the lowest spec version, forcing many customers to upgrade. I suspect this will happen with the watch as well, with many being forced to upgrade to the steel version.

THE BEST COMMENTARY and ANALYSIS I have seen on the Apple Watch debate!!

Kudos Sir and thanks for posting…….

now…..back to my lobster……………………..!!!

Hi Carl

Great article, and spot on in my mind. It is also interesting that the watch module was presented at the launch last year, but has not been mentioned since, and is not featured on the Watch website. Maybe because Apple wants to keep secret their supply chain design and optimisation.

By the way, didn’t you write on the Blackfriars blog on the ‘Tyranny of Choice’ back in the days of the iPod?!

@tom – there is no evidence that Apple “restricted supply” of the low end iPad to force purchase of the pricier models. None. Just as there is no evidence of that happening now with the watch. The whole “intentional constraint” meme is a myth. You don’t get to be the most profitable public company ever by not selling goods or upsetting customers. You get to be it by selling what people want.

I took a stab at estimating watch shipments based on relative search volume. I get 1.6 – 2.4M as my range for Q2:

https://medium.com/@mmullany/forecasting-apple-watch-units-in-q2-15-using-google-trends-5e0bd238d870

Fantastic analysis. Love the lobster analogy

Nice work, Carl. I enjoyed your Blackfriars blog a great deal. You were the Horace Dediu of Apple, before there was a Horace Dediu!

I found it interesting, and odd, that Slice’s self-selecting group of shoppers had no Edition buyers. I think the Steel model, might ultimately be more popular than the Sport one. I found that seeing the Watches in person, that I and others in the Apple Store were drawn to the Steel models. Obviously there’s greater variety amongst the Steel models, but I also felt turned off by the Sport’s rather 5c-ish colors. I didn’t like the iPhone 5c and I didn’t particularly like the Sport colors. Having said that, the black model was by far the most attractive of the Sport models and the sparse survey data so far seems to support that notion.

Interesting that we’re talking about the Watch as a new category, because all of their products (except for the iPod) can been seen as simply the natural progression of computing. As much credit as they get for innovation, in another sense, maybe it’s not a focus on “new for the sake of new” as much as merely focusing on the user experience and seeing where that leads.

I think that’s the Watch’s secret sauce. It took thousands of years for time pieces to evolve from sun dials to clock towers to Grandfathers and cuckoos to wrist watches. Similarly, computing has gone faster/smaller/more personal as it has morphed from mainframes to work stations to laptops and then phones. Two lines of evolution meeting on the wrist just seems inevitable.

Great analysis, Carl. Thanks for writing.

I bought an Apple Watch on launch day, and I am super excited to get my hands on it. This was a great post talking about design, supply chain and how they could potentially do those volumes. But to me these volumes cannot be achieved if the “use cases” and the reasons why people would use them can be identified by the community of devs. I feel like this is still the missing part to the whole smartwatch concept. Carl, do you know or can speculate as to what Apple is doing to support this?

I think you are spot in in regards to upgrades and form factor. People who think there will be a whole new watch next year, why?

People forget that the watches are mostly extensions of the phone itself, and the phone will be upgraded over time – inherently improving the watch as a result. On top of that native apps from developers arriving sometime later this year, and there will be plenty of improvements over the next two years for consumers to see without having to change hardware.

Thanks to all for the kind words. Those of you who remember me from writing at Blackfriars certainly have long memories! And yes, I did write “The Tyranny of Choice” among other pieces.

Thanks to all for reading and providing comments,

Carl

Hi Carl, great write-up. As an amateur editor, I’d counsel you to chip back on the word “believe” (18 times in this article, twice in one sentence). If you are writing a commentary/opinion piece, it is what you believe…

Does anybody remember iOS 2.0? Buggy, laggy, not very responsive and just generally a rather poor experience. They improved it and fixed the issues, but it took a bit of time. iOS 1.0 was a higher quality product.

There’s even a name for that, second system effect. It can happen when things go really well for v1.0 but they don’t get to do everything they want. Hold off on that feature, v2. Keep doing that and v2 gets big and bloated. Brooks book “The Mythical Man Month” discusses it.

I got to laugh at people who waited for iOS 2. I got to spend a year using an iPhone, and you got to experience a poor OS.

Also, from what I have heard about Apple’s obsessive prototyping, what shipped isn’t really v1.0. They’ve gone through many revisions already.

“Apple has manufactured about 5,000 each of the 8 different models of Apple Watch Editions….” Isn’t there only 4 different models of the Apple Edition? Rose gold in 38mm, rose gold in the 42mm, yellow gold in the 38mm and yellow gold in the 42mm? Or am I missing something!

To Bob re my overuse of “I believe”, thank you for the observation, and I take your point. I take some small comfort in the fact that I’ve now made my point, albeit with the subtlety of a ton of bricks: this piece isn’t an official publication of a research company, but just one person’s opinion. The transition from professional mobile analyst to a big data consultant with opinions will demand some new language, and I must admit, I don’t think I’ve entirely found it yet. I believe (sorry, couldn’t resist) that it will come with practice.

I’ll do better in future pieces.

Carl

Re the number EDITION products, Apple shows 8 on it’s EDITION page, so that’s what I counted.

http://store.apple.com/us/buy-watch/apple-watch-edition

Re margins, I stand corrected; I found a re/code article claiming that iPhone 6 and 6+ margins are 68-69%.

http://recode.net/2014/09/23/teardown-shows-apples-iphone-6-cost-at-least-200-to-build/

The good news: Watch’s parts costs will likely be lower, yet blended ASPs will come out about the same or higher than iPhone. I’ll post the analysis this week once I finish the things I get paid to do first.